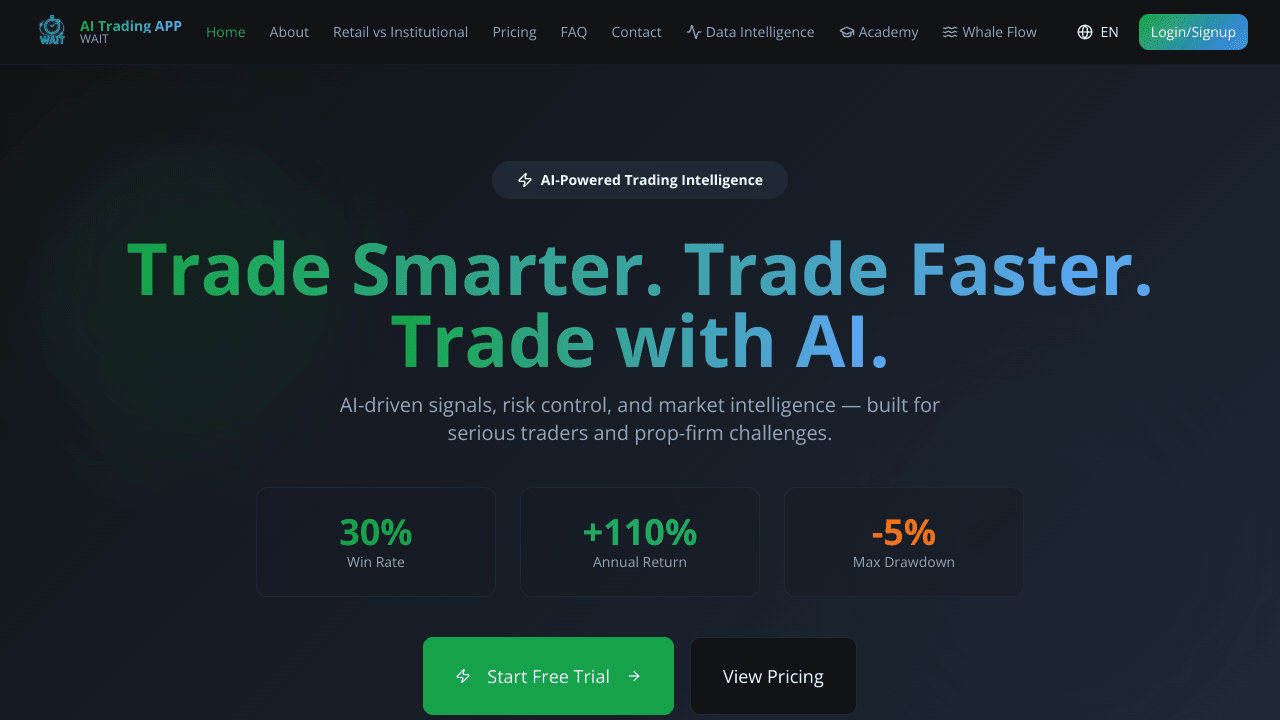

WAITINC

WAIT Inc. is an AI-driven trading intelligence platform built for serious traders, prop-firm candidates, and performance-focused institutions. We do not operate as a broker or advisor. We provide technology: real-time market signals, regime detection, and automated risk enforcement that helps users trade with discipline and consistency. At its core, WAIT transforms raw market data into actionable intelligence. Our system ingests multi-timeframe price, volume, and volatility data across crypto and forex markets, applies deterministic analytics and machine-learning models, and outputs high-confidence trade opportunities with transparent risk parameters. Every signal is scored, filtered, and aligned with market conditions, so users understand why a trade exists, not just that it exists. What differentiates WAIT is its risk-first architecture. The platform enforces capital-preservation rules inspired by professional trading environments: daily loss limits, drawdown controls, regime mismatch filters, and confidence gates. This makes WAIT uniquely suited for prop-firm challenges and disciplined growth, reducing overtrading and emotional decision-making. WAIT is built as a modular microservices platform. The same infrastructure that powers trading intelligence can be deployed in other data-intensive industries such as water-quality forecasting, cybersecurity analytics, or operational risk monitoring. Each service—data ingestion, signal generation, regime detection, risk engines, and dashboards—can be reused or adapted across verticals, making WAIT not just a product, but a scalable intelligence framework. Our mission is simple: replace guesswork with structured intelligence. WAIT gives traders and institutions a professional-grade decision engine that protects capital, enforces discipline, and turns complex markets into clear, actionable insights.